On April 10, 2018, the City of Harvey announced that it was laying off 40 people, including nearly half of its firefighters and police force. City officials said the dramatic action was taken because the Illinois Comptroller, Susana Mendoza, was intercepting state revenue that would otherwise go to Harvey, and diverting it instead to Harvey’s police and fire pension funds. The Comptroller’s action was taken because of a 2011 state law that requires her office, when requested by the funds, to do so when municipalities do not make their obligated pension payments. For years, Harvey has underfunded its pension funds. Harvey is not, however, alone. In this piece I review the 2011 law and identify other municipalities that likely underfunded their local police and fire pension funds between 2003 and 2010.

Police and Fire Pension Funds in Illinois

There are over 600 individual police and fire pension funds in Illinois, and municipal governments make contributions to them each year according to a formula dictated by state statute. Public Act (PA) 96-1495, effective January 1, 2011, requires each municipality to contribute an annual amount to its pension systems so that each will be 90% by the end of Fiscal Year 2040. If a municipality fails to properly fund its pensions then the funds can contact the Illinois Comptroller. The Comptroller will then divert any state revenue shared with the municipality and direct that money to the pension systems instead. While the law first came into effect in 2011, the funding enforcement mechanism did not begin until FY2016.

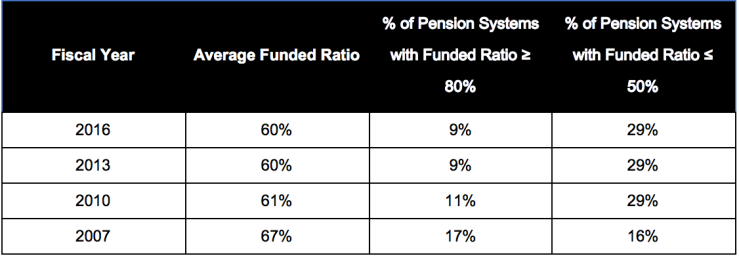

Most police and fire pension systems in Illinois are underfunded. As of FY2016, the latest data available, the average funded ratio (a measure of fiscal health) for all non-Chicago police and fire pension systems in Illinois was approximately 60%, which is not that different from the average in 2010, as shown in Table 1. Only 54 pension systems—or about 9%—were reasonably well funded (meaning they had a funded ratio of at least 80%).

Table 1 shows the average funded ratio for police and fire pension funds in Illinois, as well as the portions of funds that are well funded and significantly underfunded (funded ratio of 50% or less).

Table 1: Average Funded Ratio for All Police and Fire Pension Systems

Municipalities’ pension contributions are tied to the financial condition of the funds, meaning that what they have to pay to the funds each year is higher than if the funds were well funded. That, coupled with the new funding enforcement mechanism, put significant pressure on municipalities. In response to the new funding law, a group of 24 mayors held a press conference in April of 2014 and asked the General Assembly to pass legislation to reduce their required police and fire pension fund contributions. Later that year the mayor of North Riverside proposed privatizing his city’s fire department as a way to reduce pension costs.

How Many Funds May be Subject to the Comptroller’s Intercept?

Harvey is one of the first municipalities to have revenue intercepted by the Comptroller; however, other municipalities may soon follow. Though the pre-2011 law did require pension contributions, it lacked an enforcement mechanism, and so in practice municipalities could–and did–significantly underfund their pension systems. Using data from the Illinois Department of Insurance (DOI)*, I compared the amount of money that the DOI said municipalities should have contributed between 2003 and 2010 with municipalities’ actual contributions.

Before digging into that data there are two important reasons why actual contributions may differ some from what DOI said should have been paid. First, a municipality’s required pension contribution can be determined by the Department of Insurance, an actuary hired by the fund, or an actuary hired by the municipality, and this could lead to three different determinations of a municipality’s required pension contribution. Second, actual contributions were self-reported and municipalities may have reported incorrect information due to the difference between the property tax year and when their actual pension contributions are made. Because of the property tax cycle, a municipality’s contribution for FY2018 may not actually get paid until FY2019 when the money is received from property tax payments. Based on the available data, these two issues make it difficult to conclude with certainty whether municipalities were deliberately underfunding their pensions. That being said, there are instances where it’s not hard to tell. For example, Harvey was supposed to pay $809 thousand to its police pension fund in 2010, but reported paying $0.

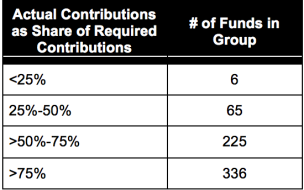

Table 2 shows the number of municipalities that are in one of four groups for the share of required contributions actually paid. As Table 2 shows the majority of funds contributed more than 75% of what DOI said they should have between 2003 and 2010. Among the 632 funds I examined the average was 80%. So the data indicates that most municipalities were likely paying what they were supposed to contribute to their police and fire pension funds.

Table 2: Share of Required Contributions Actually Contributed

Out of 632 police and fire funds, I identified 71 (or 11%) in which actual contributions were 50% or less than what the Department of Insurance said the total contributions should have been during that time. Those funds are located in 54 municipalities, the majority of which (49 funds) are in Cook County or DuPage County. Among the group of 71 funds, the average amount that was contributed between 2003 and 2010 was only about 39% of what DOI said should have been paid. And 24% of the funds received no money from their respective municipality at least once between 2003 and 2010. As a group, these 71 funds are also in worse financial shape than most police and fire pension funds. While the average funded ratio for all funds in 2016 was 60% the average for these 71 is just 47%.

What my analysis doesn’t address, however, is why municipalities’ actual contributions were significantly less than what DOI said they should have paid. Like the State of Illinois, they may have been using revenue for their operating budgets instead of properly funding their pensions. Importantly, the new pension funding enforcement mechanism will not resolve any underlying structural issues that may have led to the pension underfunding in the first place. Harvey, for example, has numerous challenges. Its population decreased by nearly 5,000 (-14%) between 2000 and 2016, while its poverty rate increased from an already high 22% in 2000 to nearly 38% in 2016. The city has also been accused of fiscal mismanagement, and Harvey’s current Mayor is barred from the municipal bond market. Harvey also already has a high property tax rate. Its composite property tax rate in 2016 was 24%, which was one of the highest in suburban Cook County and much higher than the average rate (14%) for the region.

Moreover, if state revenue is a significant revenue source for a municipality’s operating budget the pension intercept will just shift the problem from being a pension problem to an operating budget problem. In 2016, over a quarter of Harvey’s operating revenue came from the state, and at that time the city was already running a deficit. Putting aside questions of fiscal mismanagement it’s clear that Harvey’s tax base alone is not sufficient to properly fund its pensions and provide important public services. While having state funds diverted to Harvey’s police and fire pension funds will improve their financial condition it will not resolve the city’s underlying issues.

So what’s the solution? I don’t have a good answer, but it’s clear that Harvey cannot solve its issues on its own, and just cutting services is not a good option. Part of my hesitation to recommend any solution is that without having updated, comprehensive financial data for Harvey, it’s difficult to know the full scope of its fiscal challenges. Harvey is also unlikely to be the only municipality in this circumstance. As I previously mentioned, there are 53 other municipalities in which the police and fire pension funds have been similarly underfunded, and those are just the most egregious cases. The first step that’s needed is getting a handle on the problem–are the differences between what DOI said should have been paid and what was paid due to deliberate underfunding? How many municipalities are continuing to underfund their police and fire pensions? How many of those municipalities already have high property taxes and shrinking populations? For those municipalities, what portion of their total revenue comes from the state? Answering these questions is a vital first step in crafting thoughtful policy than can address the fiscal challenges local governments are facing.

*I obtained the data on actual versus required contributions from the Department of Insurance through a Freedom Information Act request while a researcher at the Center for Tax and Budget Accountability.